- Home

- About Us

- Our Products

- KGF Equity Backed Guarantees

- Treasury Backed Guarantees

- ACTIVE SUPPORT PACKAGES(2023)

- EXPORT SUPPORT PACKAGE

- INVESTMENT SUPPORT PACKAGE

- SUPPORT PACKAGE FOR OPERATING EXPENSES

- INVESTMENT-PROJECT FINANCE SUPPORT PACKAGE

- MANUFACTURING INDUSTRY SUPPORT PACKAGE

- OPERATING EXPENSES SUPPORT PACKAGE FOR 6 FEBRUARY EARTHQUKES

- INVESTMENT SUPPORT PACKAGE FOR 6 FEBRUARY EARTHQUAKES

- SUPPORT PACKAGE FOR SEVERANCE PAYMENT OF RETIREMENT AGE VICTIMS

- REGIONAL SME SUPPORT

- SUPPORT PACKAGE FOR ACTIVITIES GENERATING FX-BASED INCOME

- SUPPORT PACKAGE FOR WOMEN ENTREPRENEURS

- ENTREPRENEUR SUPPORT PACKAGE

- SUPPORT PACKAGE FOR GREEN TRANSFORMATION AND ENERGY EFFICIENCY

- TECHNOLOGY SUPPORT PACKAGE

- SUPPORT PACKAGE FOR DIGITAL TRANSFORMATION

- EDUCATIONAL SUPPORT PACKAGE

- ACTIVE SUPPORT PACKAGES(2022)

- Other >

- Export Support Package

- Cold Air Units And Frigorific Vehicles Support Package

- Investment Support Package

- Additional Employment Support Package

- Manufacturing Based Import Substitution Support Package

- (KOBI DEGER LOANS)

- Treasury Fund (32,5 Billion TL)

- Treasury Fund (52,5 Billion TL)

- Treasury Fund (200 Billion TL)

- EKONOMI DEGER LOANS

- (KOBI DEGER LOANS II)

- TOBB NEFES LOAN 2020 SUPPORT

- ACTIVE SUPPORT PACKAGES(2023)

- Our Supports

- Information Center

- Press

- Contact Us

WHAT IS KGF?

KGF acts as a guarantor for SMEs and non-SME enterprises that cannot get a loan due to insufficient collateral. KGF supports SMEs and non-SME enterprises in access to financing.

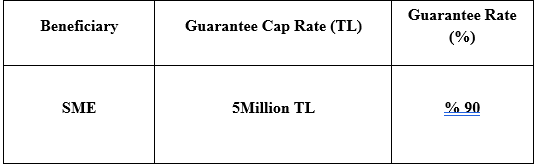

REGIONAL SME SUPPORT

Product Description

This support is aimed at financing the operating and investment expenditures of eligible SMEs, particularly those operating in the manufacturing industry, under the Joint Financing Support Program implemented in cooperation with the Small and Medium Enterprises Development Organization (KOSGEB) and Development Agencies.

Resource for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Emlak Katılım Bankası, Garanti Bankası, Halkbank, QNB FinansBank, Şekerbank, Türkiye Kalkınma ve Yatırım Bankası VakıfBank, Vakıf Katılım Bankası, Yapı Kredi Bankası, Ziraat Bankası, Ziraat Katılım Bankası

Product Maturity

Investment Loan -Maximum 120 months maturity (including the grace period)-Maximum 24 months grace period

Working Capital Loan - -Maximum 36 months maturity (including the grace period)-Maximum 12 months grace period

Guarantee Cap Rate and Guarantee Rates

Loan Products Available

- Business Credit Cards

- New Credit Card allocation

- Working capital loans that are to be disbursed to create a positive balance after making payments (including the following months) to a new Credit Card or existing Credit Cards that have no risk balance (Installment Loan, Spot Loan, Usury, etc.)

- Connected to a Debit/Bank Card;

- Overdraft Account (even if the beneficiary already has an account, a new overdraft account specific to this program must be opened)

- Installment Loan, Spot Loan, Usury, etc

- Working Capital Loan / Usury (*)

- Installment Loan

- Spot Loan

- Revolving Loan

- Cashless Overdraft Account products

- Other approaches suitable for Participation Banking

- Investment Loan (**)

- Installment Loan

- Other approaches suitable for Participation Banking including Finance Lease

(*)Participation Banks may disburse loans through appropriate methods for participation banking, regardless of Debit/Business Card

(** )Under this support package, beneficiaries using investment loans can use working capital loans aside from investment loans, provided that the working capital loan does not exceed 10% of the investment loan and is disbursed by the same Creditor.

Fee and Commission Rates

- The KGF shall collect, in return for each guarantee it gives, a one-time commission corresponding to 0.5% of the respective guarantee amount from the beneficiaries through the lenders. In the event of debt restructuring, a commission amounting to 0.5% of the balance amount of the guarantee shall be collected in advance from the beneficiaries through creditors.

- In retun for each loan disbursed, creditors may collect a commission amounting to a maximum of 1% of the loan amount from the beneficiaries.

Special Conditions

- This package shall be available for SMEs that are entitled to receive support under the joint financing support program implemented in cooperation with KOSGEB and Development Agencies.

- Beneficiaries are required to notify Creditors that they have received financial support under the joint financing support program with an attached e-signed letter issued by the respective institution (KOSGEB/Development Agencies).

- Loans under this package cannot be used for investments in land or buildings.

- Beneficiaries may receive a cash amount of not more than 10% of the working capital loan allocated to them to use for operating expenses (A working capital loan will be made available by the same Creditor).

- Beneficiaries may take out a working capital loan within the package, aside from the investment loan limit.

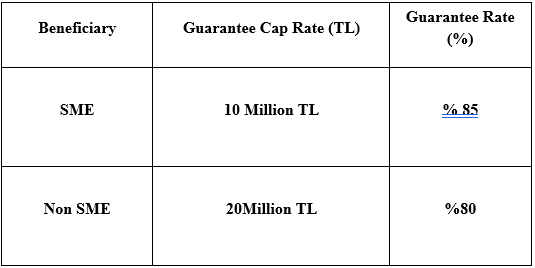

SUPPORT PACKAGE FOR ACTIVITIES GENERATING FX-BASED INCOME

Product Description

This package is aimed at increasing the number of exporter enterprises and export volumes, and can be used by SMEs and non-SMEs that are either exporters or that operate in sectors generating foreign exchange income.

Resource for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Akbank, Albaraka Türk Katılım Bankası, Denizbank, Emlak Katılım Bankası, Garanti Bankası Halkbank,ING, İş Bankası, Kuveyt Türk Katılım Bankası, QNB FinansBank, Şekerbank, VakıfBank, Vakıf Katılım Bankası, Yapı Kredi Bankası, Ziraat Bankası, Ziraat Katılım Bankası

Product Maturity

Investment Loan -Maximum 120 months maturity (including the grace period)-Maximum 24 months grace period

Working Capital Loan - -Maximum 36 months maturity (including the grace period)-Maximum 12 months grace period

Guarantee Cap Rate and Guarantee Rates

The guarantee rate for rediscount loans is 100%.

Loan Products Available

- Cash Loan

- Installment Loan

- Spot Loan

- Revolving Loan

- Cashless Overdraft Account products

- Other approaches suitable for Participation Banking

- Non-cash Loan(**) (***)

(*)Guarantees are provided for loans provided to exporters originating from the Lender or to companies with foreign exchange earning activities, provided that these loans are committed in TL/Foreign currency. This condition is not sought for guarantees provided to tourism companies

(**) Letters of guarantee to be issued for Rediscount loans only to Eximbank

(***)In non-cash loan disbursements, the Lender will not receive a letter of guarantee commission other than the 1% commission.

Fee and Commission Rates

- The KGF shall collect, in return for each guarantee it gives, a one-time commission corresponding to 0.5% of the respective guarantee amount from the beneficiaries through the lenders. In the event of debt restructuring, a commission amounting to 0.5% of the balance amount of the guarantee shall be collected in advance from the beneficiaries through creditors.

- In retun for each loan disbursed, creditors may collect a commission amounting to a maximum of 1% of the loan amount from the beneficiaries. In case the maturity of the loan is less than 1 year, the maximum rate is applied according to the three-month maturities.

Special Conditions

- The guarantee rate applied is 100% for the rediscount loans to be used under this package.

- The package offers loans denominated in TRY or foreign currencies.

- Beneficiaries are required to commit to not reducing the number of employees for a period of two years from the date of loan disbursement.

- Beneficiaries may receive, for use as operating expenses, a cash amount of not more than 10% of the working capital loan allocated to them.

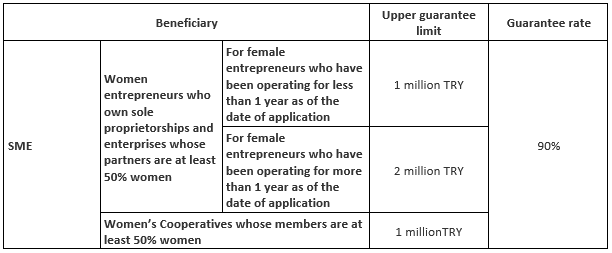

SUPPORT PACKAGE FOR WOMEN ENTREPRENEURS

Product Description

This package is aimed at supporting women entrepreneurs who want to start a new business for the production of goods and services, self-employment or commercial activity, businesses whose partners are at least 50% women, and women’s cooperatives, thus strengthening the women’s entrepreneurship ecosystem.

Resource for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Emlak Katılım Bankası, Garanti Bankası, Halkbank, İş Bankası, Kuveyt Türk Katılım Bankası, Vakıfbank, Vakıf Katılım Bankası, Yapı ve Kredi Bankası, Ziraat Bankası, Ziraat Katılım Bankası

Product Maturity

Investment Loan -Maximum 60 months maturity (including the grace period)-Maximum 12 months grace period

Working Capital Loan - -Maximum 36 months maturity (including the grace period)-Maximum 12 months grace period

The disbursement period for loan products deemed eligible under this package will be 12 months, provided that this period does not go beyond December 31, 2024 (in line with banking practices, an exceptional one-month duration can be added to the loan period if needed).

Guarantee Cap Rate and Guarantee Rates

Loan Products Available

- Business Credit Cards

- New Credit Card allocation

- Working capital loans that are to be disbursed to create a positive balance after making payments (including the following months) to a new Credit Card or existing Credit Cards that have no risk balance (Installment Loan, Spot Loan, Usury, etc.).

- Connected to a Debit/Bank Card;

- Overdraft Account (even if the beneficiary already has an account, a new overdraft account specific to this program must be opened)

- Installment Loan, Spot Loan, Usury, etc

- Working Capital Loan / Usury (*)

- Installment Loan

- Spot Loan

- Revolving Loan

- Cashless Overdraft Account products

- Other approaches suitable for Participation Banking

- Investment Loan (**)

- Installment Loan

- Other approaches suitable for Participation Banking including Finance Lease

(*)Participation Banks may disburse loans through appropriate methods for participation banking, regardless of Debit/Business Card

**This support package allows debtors who use investment loans under this package to access additional working capital loans not exceeding 10% of the respective investment loan, provided that the working capital loan is disbursed by the same creditor. In any case, the sum of the investment loans used and the operating loans cannot exceed 70% of the investment amount

Fee and Commission Rates

- The KGF shall collect, in return for each guarantee it gives, a one-time commission corresponding to 0.5% of the respective guarantee amount from the beneficiaries through the lenders. In the event of debt restructuring, a commission amounting to 0.5% of the balance amount of the guarantee shall be collected in advance from the beneficiaries through creditors.

- In retun for each loan disbursed, creditors may collect a commission amounting to a maximum of 1% of the loan amount from the beneficiaries.

Special Conditions

- Beneficiaries may receive, for use as operating expenses, a cash amount of not more than 10% of the working capital loan allocated to them

- Credit cards will be restricted for cash advances.