Product Description

To meet the extensive guarantee cap rate demands of the Banks by our institution and to ensure the continuity of support provided to SMEs, the KGF Support Loan 2 program will be created with a loan volume of 2.5 billion TL as a separate package to be allocated from the equity of our institution.

Targeted Guarantee Volume: 6 billion TL

Application Deadline: 31.05.2022

Cap rate : 7%

Source for Guarantee

KGF Equity

Related Financial Institutions / Corporations

Akbank, Albaraka Türk Katılım Bankası, Denizbank, Emlak Katılım, Garanti Bankası, Halkbank, İş Bankası, QNB Finansbank, Şekerbank, TEB, Vakıfbank, Vakıf Katılım Bankası, Yapı Kredi Bankası, Ziraat Bankası, Ziraat Katılım Bankası

Product Maturity

Maximum 48 months, including a maximum grace period of 12 months

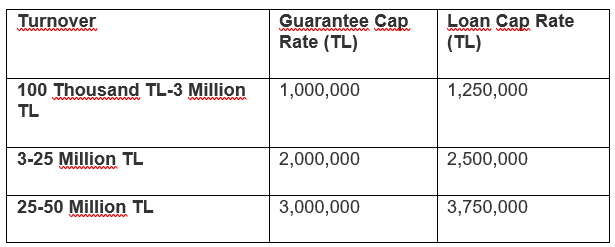

Guarantee Cap Rate and Guarantee Rates

Loan Interest Rate for Beniciaries

Lenders can freely determine it as per loan policies.

Fee and Commission

- Based on the guarantee fees per transaction and for every new guarantee application or configuration/resetting maturity applications, the lender will deposit the application fee of 500 TL for up to 1 million TL, TL 1,000 TL for 1-2 Million TL, 1,000 TL for 1-2 Million TL and 1,500 TL for 2-3 million TL to the institution's account. If the beneficiary is not included in the portfolio for any reason and the configuration process is abandoned, the application fee charged will not be refunded.

Special Conditions

- The guarantee requests made under the program's scope will only be made in TL.

- No loans can be disbursed after 31.05.2022, which is the deadline for inclusion in the portfolio.

- Only new and additional loan disbursements will be made.

- Loans covered by this package cannot be used for the following:

- Foreign currency, gold and jewelry financing,

- Portfolio management companies and brokerages,

- In any investment instrument of any lender,

It can only be deposited as a term/current deposit in the bank from which the loan is taken until the expenditure is made.

If a violation of the abovementioned issues is identified, the guarantee is void for the unused portion of the loan.

- The institutional guarantee can be requested only for new and additional loan disbursements. The loans to be made available to the beneficiary will also not be used to cover the risks of the company and the group company. In the event of the violation of this article, such guarantees shall be void from the date of allocation of the guarantee. The lender pays the compensation for the guarantees within this scope directly to the institution upon the initial written notice of the institution, together with a 20% interest rate starting from the date of compensation without the need for a warning and court order.

- The institution reserves the right whether or not to include the loan in the portfolio after checking the loan worthiness of the lender who has applied via KOBIT. The lender can only apply for transactions that meet all criteria. The inclusion of the application in the portfolio does not imply confirmation of compliance with the criteria.