Product Description

This package is aimed at providing financing to SMEs and non-SMEs that have an Investment Incentive Certificate (IIC) to cover investment and investment-related operating expenses.

Fund Used for Guarantee

Treasury Fund

Relevant Financial Institutions / Institution

Akbank, Denizbank, Garanti Bankası, Halkbank, İş Bankası, Türk Ekonomi Bankası, Türkiye Sınai Kalkınma Bankası, QNB Finansbank, Vakıfbank, Yapı Kredi Bankası, Ziraat Bankası

Term of Product

For Investment Loans

- A grace period for principal amount for a maximum of 12 months

- A maximum of 120 months maturity (including the grace period for principal amount)

For Business Loans

- A grace period for principal amount for a maximum of 6 months

- A maximum of 24 months maturity (including the grace period for principal amount)

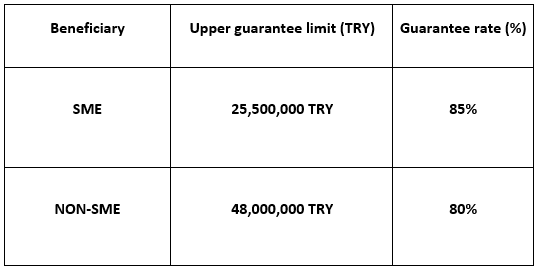

Guarantee Limits and Rates

Loan Products Available (*)

1.Business Credit Cards

- New Credit Card allocation

- Working capital loans that are to be disbursed to create a positive balance after making payments (including the following months) to a new Credit Card or existing Credit Cards that have no risk balance (Installment Loan, Spot Loan, Usury, etc.).

2.Connected to a Debit/Bank Card:

- Overdraft Account (even if the beneficiary already has an account, a new overdraft account specific to this program must be opened)

- Installment Loan, Spot Loan, Usury, etc.

3.Working Capital Loan / Usury

- Installment Loan

- Spot Loan

- Revolving Loan

- Cashless Overdraft Account products

- Other approaches suitable for Participation Banking

4.Investment Credit

Fee and Commission Rates

- The institution shall collect, in return for each guarantee it gives, a one-time commission corresponding to 0.5% of the respective guarantee amount from the beneficiaries through the lenders. In the event of debt restructuring, a commission amounting to 0.5% of the balance amount of the guarantee shall be collected in advance from the beneficiaries through creditors.

- The lender may collect from beneficiaries a one-off commission equal to 1% of the loan amount in cash for each loan disbursement from the beneficiaries in return for the loan.

Special Conditions

- The amount of an investment loan cannot exceed 70% of the investment amount specified in the IIC. Accordingly, all information on the Investment Incentive Certificate and the respective investment should be entered completely and accurately on the guarantee application.

- Beneficiaries can use working capital loans aside from investment loans, provided that the working capital loan does not exceed 10% of the investment loan and is disbursed by the same creditor.

- No invoice is required to be submitted for loans to be disbursed either through card payment systems or in cash.

- Credit cards will be restricted for cash advances.

- Guarantees for investments in land and buildings can only be given if the investment includes machinery, aside from in the tourism sector.

- Banking standard practices will apply for Credit Cards or revolving loans under Debit Cards, and limits can be reused after beneficiaries make any payments.

- When calculating the investment loan amount that can be provided under this package, only the project amount planned/committed by the enterprise under its Investment Incentive Certificate (YTB) shall be taken into account. The amount of an investment loan cannot exceed 70% of the investment amount specified in the IIC.

- It is the Lenders’ responsibility to credit the same investment by more than one Lender, provided that the total amount of the loan does not exceed 70% of the investment amount specified in the IIC.