Product Description

This package is aimed at increasing the number of exporter enterprises and export volumes, and can be used by SMEs and non-SMEs that are either exporters or that operate in sectors generating foreign exchange income.

Resource for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Akbank, Albaraka Türk Katılım Bankası, Denizbank, Emlak Katılım Bankası, Garanti Bankası Halkbank,ING, İş Bankası, Kuveyt Türk Katılım Bankası, QNB FinansBank, Şekerbank, VakıfBank, Vakıf Katılım Bankası, Yapı Kredi Bankası, Ziraat Bankası, Ziraat Katılım Bankası

Product Maturity

Investment Loan -Maximum 120 months maturity (including the grace period)-Maximum 24 months grace period

Working Capital Loan - -Maximum 36 months maturity (including the grace period)-Maximum 12 months grace period

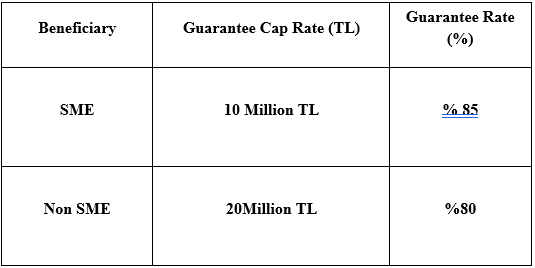

Guarantee Cap Rate and Guarantee Rates

The guarantee rate for rediscount loans is 100%.

Loan Products Available

- Cash Loan

- Installment Loan

- Spot Loan

- Revolving Loan

- Cashless Overdraft Account products

- Other approaches suitable for Participation Banking

- Non-cash Loan(**) (***)

(*)Guarantees are provided for loans provided to exporters originating from the Lender or to companies with foreign exchange earning activities, provided that these loans are committed in TL/Foreign currency. This condition is not sought for guarantees provided to tourism companies

(**) Letters of guarantee to be issued for Rediscount loans only to Eximbank

(***)In non-cash loan disbursements, the Lender will not receive a letter of guarantee commission other than the 1% commission.

Fee and Commission Rates

- The KGF shall collect, in return for each guarantee it gives, a one-time commission corresponding to 0.5% of the respective guarantee amount from the beneficiaries through the lenders. In the event of debt restructuring, a commission amounting to 0.5% of the balance amount of the guarantee shall be collected in advance from the beneficiaries through creditors.

- In retun for each loan disbursed, creditors may collect a commission amounting to a maximum of 1% of the loan amount from the beneficiaries. In case the maturity of the loan is less than 1 year, the maximum rate is applied according to the three-month maturities.

Special Conditions

- The guarantee rate applied is 100% for the rediscount loans to be used under this package.

- The package offers loans denominated in TRY or foreign currencies.

- Beneficiaries are required to commit to not reducing the number of employees for a period of two years from the date of loan disbursement.

- Beneficiaries may receive, for use as operating expenses, a cash amount of not more than 10% of the working capital loan allocated to them.