- Home

- About Us

- Our Products

- KGF Equity Backed Guarantees

- Treasury Backed Guarantees

- ACTIVE SUPPORT PACKAGES(2023)

- EXPORT SUPPORT PACKAGE

- INVESTMENT SUPPORT PACKAGE

- SUPPORT PACKAGE FOR OPERATING EXPENSES

- INVESTMENT-PROJECT FINANCE SUPPORT PACKAGE

- MANUFACTURING INDUSTRY SUPPORT PACKAGE

- OPERATING EXPENSES SUPPORT PACKAGE FOR 6 FEBRUARY EARTHQUKES

- INVESTMENT SUPPORT PACKAGE FOR 6 FEBRUARY EARTHQUAKES

- SUPPORT PACKAGE FOR SEVERANCE PAYMENT OF RETIREMENT AGE VICTIMS

- REGIONAL SME SUPPORT

- SUPPORT PACKAGE FOR ACTIVITIES GENERATING FX-BASED INCOME

- SUPPORT PACKAGE FOR WOMEN ENTREPRENEURS

- ENTREPRENEUR SUPPORT PACKAGE

- SUPPORT PACKAGE FOR GREEN TRANSFORMATION AND ENERGY EFFICIENCY

- TECHNOLOGY SUPPORT PACKAGE

- SUPPORT PACKAGE FOR DIGITAL TRANSFORMATION

- EDUCATIONAL SUPPORT PACKAGE

- ACTIVE SUPPORT PACKAGES(2022)

- Other >

- Export Support Package

- Cold Air Units And Frigorific Vehicles Support Package

- Investment Support Package

- Additional Employment Support Package

- Manufacturing Based Import Substitution Support Package

- (KOBI DEGER LOANS)

- Treasury Fund (32,5 Billion TL)

- Treasury Fund (52,5 Billion TL)

- Treasury Fund (200 Billion TL)

- EKONOMI DEGER LOANS

- (KOBI DEGER LOANS II)

- TOBB NEFES LOAN 2020 SUPPORT

- ACTIVE SUPPORT PACKAGES(2023)

- Our Supports

- Information Center

- Press

- Contact Us

WHAT IS KGF?

KGF acts as a guarantor for SMEs and non-SME enterprises that cannot get a loan due to insufficient collateral. KGF supports SMEs and non-SME enterprises in access to financing.

INVESTMENT SUPPORT PACKAGE

Product Description

This package is aimed at providing financing to SMEs and non-SMEs that have an Investment Incentive Certificate (IIC) to cover investment and investment-related operating expenses.

Fund Used for Guarantee

Treasury Fund

Relevant Financial Institutions / Institution

Akbank, Denizbank, Garanti Bankası, Halkbank, İş Bankası, Türk Ekonomi Bankası, Türkiye Sınai Kalkınma Bankası, QNB Finansbank, Vakıfbank, Yapı Kredi Bankası, Ziraat Bankası

Term of Product

For Investment Loans

- A grace period for principal amount for a maximum of 12 months

- A maximum of 120 months maturity (including the grace period for principal amount)

For Business Loans

- A grace period for principal amount for a maximum of 6 months

- A maximum of 24 months maturity (including the grace period for principal amount)

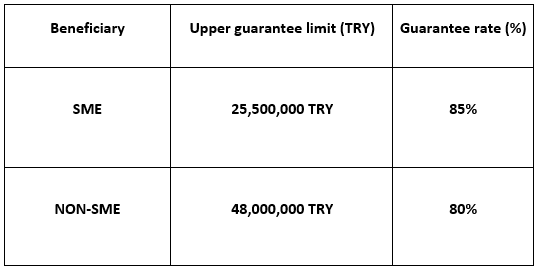

Guarantee Limits and Rates

Loan Products Available (*)

1.Business Credit Cards

- New Credit Card allocation

- Working capital loans that are to be disbursed to create a positive balance after making payments (including the following months) to a new Credit Card or existing Credit Cards that have no risk balance (Installment Loan, Spot Loan, Usury, etc.).

2.Connected to a Debit/Bank Card:

- Overdraft Account (even if the beneficiary already has an account, a new overdraft account specific to this program must be opened)

- Installment Loan, Spot Loan, Usury, etc.

3.Working Capital Loan / Usury

- Installment Loan

- Spot Loan

- Revolving Loan

- Cashless Overdraft Account products

- Other approaches suitable for Participation Banking

4.Investment Credit

Fee and Commission Rates

- The institution shall collect, in return for each guarantee it gives, a one-time commission corresponding to 0.5% of the respective guarantee amount from the beneficiaries through the lenders. In the event of debt restructuring, a commission amounting to 0.5% of the balance amount of the guarantee shall be collected in advance from the beneficiaries through creditors.

- The lender may collect from beneficiaries a one-off commission equal to 1% of the loan amount in cash for each loan disbursement from the beneficiaries in return for the loan.

Special Conditions

- The amount of an investment loan cannot exceed 70% of the investment amount specified in the IIC. Accordingly, all information on the Investment Incentive Certificate and the respective investment should be entered completely and accurately on the guarantee application.

- Beneficiaries can use working capital loans aside from investment loans, provided that the working capital loan does not exceed 10% of the investment loan and is disbursed by the same creditor.

- No invoice is required to be submitted for loans to be disbursed either through card payment systems or in cash.

- Credit cards will be restricted for cash advances.

- Guarantees for investments in land and buildings can only be given if the investment includes machinery, aside from in the tourism sector.

- Banking standard practices will apply for Credit Cards or revolving loans under Debit Cards, and limits can be reused after beneficiaries make any payments.

- When calculating the investment loan amount that can be provided under this package, only the project amount planned/committed by the enterprise under its Investment Incentive Certificate (YTB) shall be taken into account. The amount of an investment loan cannot exceed 70% of the investment amount specified in the IIC.

- It is the Lenders’ responsibility to credit the same investment by more than one Lender, provided that the total amount of the loan does not exceed 70% of the investment amount specified in the IIC.

Treasury Fund

Product Description

KGF shall provide guarantee to credits extended by the enterprises which cannot access to finance due to collateral in type and nature required by the Banks and with beneficiary type of SME.

Resource for Guarantee

Treasury Undersecretary Funds

Related Financial Institutions / Corporations

KGF shareholder banks

Product Maturity

For working capital loan maximum maturity is 5 years, grace period is 1 year.

For investment capital loan maximum maturity is 10 years, grace period is 3 years.

In case it is stipulated capital grace period more than one year, interests on the grace period shall be collected at the end of 1-year periods.

Guarantee Limit

Total guarantee limit per enterprise/ group TRY 12 million

Total guarantee limit per Large Scaled enterprises/ group: TRY 200 million

Maximum Guarantee Rate

90%

Fees and Commission

The guarantee commission is collected based on the guarantee amount of KGF once in advance at a rate of 0,03 % .

Besides, for the applications before 18th of March, the guarantee commission based on the guarantee amount of KGF will continue to be charged at a rate of 1% in advance based on guarantee risk for every year in the consecutive years.

The Bank will not charge any other expenses except for the guarantee commission which is collected based on the guarantee amount of KGF at a rate of 0,03 % and transaction costs to be paid to third parties for the operations (appraisal, insurance etc.) under Treasury Backed KGF Guarantees.

Application Conditions

-

The beneficiary is to be a real or legal entity enterprise with qualification of SME,

- The beneficiary and the companies which the beneficiary and/or shareholders are associated in severally or jointly with shares of 25% and above are in the process of bankruptcy, abolishment, suspension of bankruptcy and composition in bankruptcy during application for credit,

- Beneficiary has no overdue debt to the tax office within the scope of the Article 22/A of the Law on Collection Procedure of Public Receivables numbered 6183 and dated 21/07/1953, so as to be documented with a writ obtained on a date until 30 days ago at most during credit extension (if the debt is restructured, the structuring has not been deteriorated),

- Beneficiary should not have any overdue debt to the Social Security Institute within the scope of the Article 90 of the Social Security and General Health Insurance Law numbered 5510 and dated 31/05/2006, so as to be documented with a writ obtained on a date at most 90 days ago from the loan extension (if the debt is restructured, the structuring should not be in breach), otherwise the debt should not exceed 20% of the loan that is subject to application.

- The credits of the beneficiary should not to be one of the credits monitored in the third, fourth and fifth group, in nature of illiquid claim as per the Regulations on Determination of Nature of Credits and Other Receivables by the Banks and regarding Principles and Procedures on Reserves hereof published on the Official Gazette numbered 28861 and dated 24/12/2013, on the recent Credit Limit, Credit Risk, Receivables to be Liquidated Report obtained from the Risk Center of Banking Association of Turkey, according to the date of application to the bank, in accordance with Article 5 of the same regulation, beneficiaries should not have any legally follow-up debts.

- The credits of the beneficiary should not be one of the credits monitored in the third and fourth group, in nature of illiquid claims as per the Regulations on Determination of Nature of Credits and Other Receivables by the Banks and regarding Principles and Procedures on Reserves hereof published on the Official Gazette numbered 28861 and dated 24/12/2013, on the recent Credit Limit, Credit Risk, Receivables to be Liquidated Report obtained from the Risk Center of Banking Association of Turkey, and also, should not be considered under the 5th clause stating that loans have become illiquid within the "loans becoming non-performing as stated within the "financial leasing, factoring, accounting principles of finance companies and regulations regarding financial statements".

- In case where the application of the beneficiary falls into 3rd and 4th category of loans falling within the "Classification of loans and rules and regulations regarding the allocation of provisions" clause published in the official gazette number 29750 and dated 22.06.2016, then banks can demand guarantees for each new and additional loan in favor of the beneficiary.

FINANCIAL ENERGY SUPPORT PACKAGE FOR AGRICULTURAL PRODUCTION

Product Description

This package relates to the financing of the payment of overdue and/or new agricultural electricity bills to complement the operating expenses of Irrigation Unions, Irrigation Cooperatives and farmers, including real persons and legal entities

Resource for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Ziraat Bankası

Product Maturity

A term of 60 months for overdue agricultural electricity bills

A term of 12 months for new agricultural electricity bills

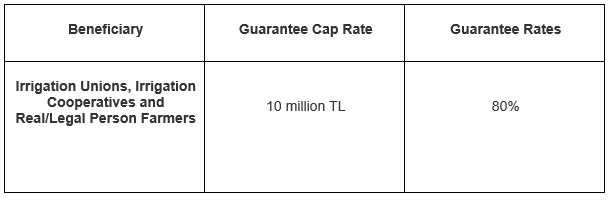

Guarantee Cap Rate and Guarantee Rates

Loan Products Available

Working Capital Loan

Fee and Commission Rates

- The KGF collects a one-time upfront commission from beneficiaries amounting to 0.35% of the guarantee amount through the lenders in return for the suretyships it provides. The beneficiaries are charged commission up front in the event of restructuring at a rate of 0.35% of the guarantee balance through lenders.

- The lender may collect from the beneficiaries a one-off commission equal to 0.5% of the loan amount in cash for each loan disbursement from the beneficiaries in return for the loan.

Special Conditions

- Within the scope of the package, loans may be extended exclusively for the financing of overdue and/or new agricultural electricity bills.

- A working capital loan allocated to a beneficiary who has an overdue agricultural electricity debt will be paid directly to the electricity distribution company to which the debt is owed.

- New agricultural electricity bills will be paid in accordance with the loan product that will function as an automatic payment order issued by the lender.

- Submission of a bill/digital bill record is required for loans to be received as part of the package.

- As regards to any overdue agricultural electricity bills, the debt status document obtained from the electricity distribution company is required to be presented during the application.

- As regards to new agricultural electricity bills, an automatic payment order and a sample past-dated bill, or (if there is no past bill) a copy of the new subscription contract, should be provided during the application, and a bill/digital bill during the disbursement of the loan