- Home

- About Us

- Our Products

- KGF Equity Backed Guarantees

- Treasury Backed Guarantees

- ACTIVE SUPPORT PACKAGES(2023)

- EXPORT SUPPORT PACKAGE

- INVESTMENT SUPPORT PACKAGE

- SUPPORT PACKAGE FOR OPERATING EXPENSES

- INVESTMENT-PROJECT FINANCE SUPPORT PACKAGE

- MANUFACTURING INDUSTRY SUPPORT PACKAGE

- OPERATING EXPENSES SUPPORT PACKAGE FOR 6 FEBRUARY EARTHQUKES

- INVESTMENT SUPPORT PACKAGE FOR 6 FEBRUARY EARTHQUAKES

- SUPPORT PACKAGE FOR SEVERANCE PAYMENT OF RETIREMENT AGE VICTIMS

- REGIONAL SME SUPPORT

- SUPPORT PACKAGE FOR ACTIVITIES GENERATING FX-BASED INCOME

- SUPPORT PACKAGE FOR WOMEN ENTREPRENEURS

- ENTREPRENEUR SUPPORT PACKAGE

- SUPPORT PACKAGE FOR GREEN TRANSFORMATION AND ENERGY EFFICIENCY

- TECHNOLOGY SUPPORT PACKAGE

- SUPPORT PACKAGE FOR DIGITAL TRANSFORMATION

- EDUCATIONAL SUPPORT PACKAGE

- ACTIVE SUPPORT PACKAGES(2022)

- Other >

- Export Support Package

- Cold Air Units And Frigorific Vehicles Support Package

- Investment Support Package

- Additional Employment Support Package

- Manufacturing Based Import Substitution Support Package

- (KOBI DEGER LOANS)

- Treasury Fund (32,5 Billion TL)

- Treasury Fund (52,5 Billion TL)

- Treasury Fund (200 Billion TL)

- EKONOMI DEGER LOANS

- (KOBI DEGER LOANS II)

- TOBB NEFES LOAN 2020 SUPPORT

- ACTIVE SUPPORT PACKAGES(2023)

- Our Supports

- Information Center

- Press

- Contact Us

WHAT IS KGF?

KGF acts as a guarantor for SMEs and non-SME enterprises that cannot get a loan due to insufficient collateral. KGF supports SMEs and non-SME enterprises in access to financing.

ENTERPRISE EXPENDITURES SUPPORT PACKAGE

Product Description

The aim is to guarantee the loans to be disbursed to meet the operating capital needs of SMEs and non-SMEs.

Source for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Akbank, Albaraka Türk Katılım Bankası, Denizbank, Garanti BBVA, Halk Bankası, ING Bank, İş Bankası, Kuveyt Türk Katılım Bankası, QNB Finansbank, Şekerbank, Türk Ekonomi Bankası, Emlak Katılım Bankası, Türkiye Finans Katılım Bankası, Türkiye İhracat Kredi Bankası, Vakıfbank, Vakıf Katılım Bankası, Yapı ve Kredi Bankası, Ziraat Bankası, Ziraat Katılım Bankası

Product Maturity

Maximum 6 months grace period

Maximum 30 months maturity (including the grace and disbursement period)

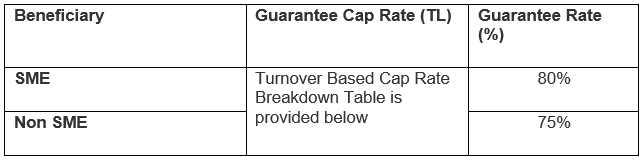

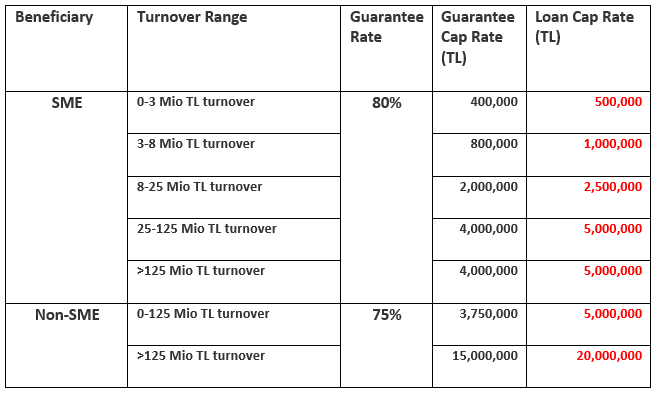

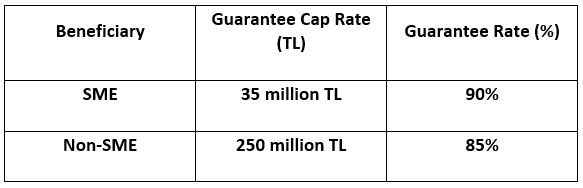

Guarantee Cap Rate and Guarantee Rates

Loan Products Available

Commercial Credit Cards

- New Credit Card allocation

- Working capital loans (such as Installment Loan, Spot Loan, Murabaha, etc.) to be disbursed to create a plus balance by paying for the new credit card or existing credit cards (including subsequent months) that do not have a risk balance.

Linked to Debit/Debit Card;

- Credit Deposit Account (even if the beneficiary currently has an account, a new credit deposit account must be opened exclusively for this program) Installment Loan, Spot Loan, Murabaha, etc.

Fee and Commission

- In exchange for the guarantees used, KGF collects, through lenders, 0.35% of the guarantee amount as a one-time upfront commission for each guarantee disbursement. In the case of configuration, 0.35% of the amount of the guarantee balance will be collected from beneficiaries as upfront commission through lenders.

- In exchange for the loan, the lender may collect from beneficiaries a maximum of 1% of the loan amount as a one-time upfront commission for each loan disbursement. If the loan's maturity is less than one year, the maximum rate is applied proportionally to the quarterly maturities.

Special Conditions

- One-off expenditures over 20,000 TL will be documented by contract or invoice.

- A maximum of 10% of the guarantee amount for the working capital loan allocated to the beneficiary will be given in cash for use in business expenses.

- For those companies with export potential to be determined by KOSGEB to benefit from the guarantee, a commitment must be made to export within the specified period as per the "Communiqué on Taxes, Duties and Charges Exceptions for Export, Transit Trade, Sales and Deliveries considered as Exports and Foreign Exchange Earning Services and Activities".

- KOSGEB will identify the SMEs with export potential, and only the data to be shared by KOSGEB will be taken as the basis to identify these companies.

- Application Deadline:31.12.2023

COLD AIR UNITS AND FRIGORIFIC VEHICLES SUPPORT PACKAGE

Product Description

In accordance with the Communiqué on Domestic Goods of the Ministry of Industry and Technology, the aim is to support SMEs' access to finance for cold air units and frigorific vehicles that hold Domestic Goods Certificate.

Source for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Kuveyt Türk Katılım Bankası, Vakıf Katılım Bankası, Ziraat Katılım Bankası, Yapı Kredi Leasing, Halk Leasing, Vakıf Leasing, Türkiye Emlak Katılım Bankası, Deniz Finansal Kiralama

Product Maturity

Maximum 36 months including 6 months grace period

Guarantee Cap Rate and Guarantee Rates

Loan Products Available

Investment loans (including Financial Leasing Transactions)

Fee and Commission

-

In exchange for the guarantees used, KGF collects, through lenders, 0.35% of the guarantee amount as a one-time upfront commission for each guarantee disbursement. In the case of configuration, 0.5% of the amount of the guarantee balance will be collected from beneficiaries as upfront commission through lenders.

-

In exchange for the loan, the lender may collect from beneficiaries a maximum of 0.35% of the loan amount as upfront commission for each loan disbursement.

Special Conditions

- Investments will be documented by contract or invoice, which will only be used to purchase cold air units and frigorific vehicles.

- Only cold air unit and frigorific vehicle investments with Domestic Goods Certificate are covered under the Communiqué on Domestic Goods of the Ministry of Industry and Technology.

MANUFACTURING BASED IMPORT SUBSTITUTION SUPPORT PACKAGE

Product Description

The aim is to guarantee loans to be used to finance investment expenditures of enterprises within the scope of the Technology Oriented Industrial Breakthrough Program and those that have a regional, priority, strategic or project-based investment incentive certificate for manufacturing industry investments (US-97 Code: 15-37) excluding the province of Istanbul.

Source for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Ziraat Bankası, Halk Bankası, Vakıfbank, Türkiye İş Bankası, Garanti Bankası, Yapı ve Kredi Bankası, Denizbank, Türk Ekonomi Bankası, Kuveyt Türk Katılım Bankası, Türkiye Finans Katılım Bankası, Ziraat Katılım Bankası, Vakıf Katılım Bankası, Türkiye Kalkınma ve Yatırım Bankası

Product Maturity

Minimum 6 months, maximum 120 months, including maximum 24 months grace period

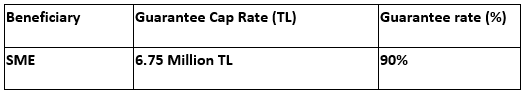

Guarantee Cap Rate and Guarantee Rates

Loan Products Available

Investment loans (including Financial Leasing Transactions)

Loan Interest Rates for Beneficiaries

Loans to be disbursed within the scope of the Manufacturing Based Import Substitution Support Package are expected to be traded provided that the following interest rates do not exceed. (Interest rates are evaluated on their own terms in configuration transactions.) The disbursement of loans at a fixed or variable interest rate will be determined according to bank preference for each transaction.

-

Considerations for Fixed Interest Rate

- For the loans to be used with the 0 to 5 years of maturity range (including 5 years): TLREF+1.50

- For the loans to be used with the 5 to 10 years of maturity range: TLREF+2,50

-

Considerations for Variable Interest Rate TLREF

Variable Interest Rate: TLREF + 1.00

Fee and Commission

- In exchange for the guarantees used, KGF collects, through lenders, 0.5% of the guarantee amount as a one-time upfront commission for each guarantee disbursement. In the case of configuration, 0.5% of the amount of the guarantee balance will be collected from beneficiaries as upfront commission through lenders.

- In exchange for the loan, the lender may collect from beneficiaries a maximum of 0.5% of the loan amount as upfront commission for each loan disbursement.

Special Conditions

- To benefit from this guarantee, enterprises must be within the scope of the Technology Oriented Industrial Action Program or have a regional, priority, strategic or project-based investment incentive certificate for manufacturing industry investments (US-97 Code: 15-37) excluding the province of Istanbul.

- One-off expenditures related to investments over 100,000 TL will be documented by contract or invoice.