Product Description

This package is aimed at financing investment and investment-related operating expenses of enterprises: that operate in technology development zones or specialized technology development zones pursuant to Law No. 4691; that operate in Technology Development Centers that have been given the right to use the name TEKMER by KOSGEB; that have obtained a Design Center Certificate and/or R&D Center Certificate from the Ministry of Industry in accordance with Law No. 5746; or that have obtained a Patent or Technological Product Experience Certificate (TUR).

Resource for Guarantee

Treasury Fund

Related Financial Institutions / Corporations

Emlak Katılım Bankası, Garanti Bankası, Halkbank, İş Bankası, Kuveyt Türk Katılım Bankası, Vakıfbank ,Vakıf Katılım Bankası,Yapı Kredi Bankası, Ziraat Bankası,Ziraat Katılım Bankası

Product Maturity

Investment Loan -Maximum 48 months maturity (including the grace period)-Maximum 12 months grace period

Working Capital Loan - -Maximum 36 months maturity (including the grace period)-Maximum 6 months grace period

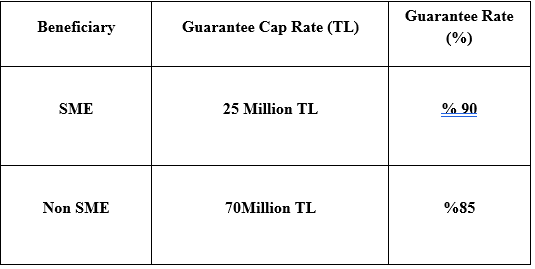

Guarantee Cap Rate and Guarantee Rates

Loan Products Available

- Business Credit Cards

- New Credit Card allocation

- Working capital loans that are to be disbursed to create a positive balance after making payments (including the following months) to a new Credit Card or existing Credit Cards that have no risk balance (Installment Loan, Spot Loan, Usury, etc.).

- Connected to a Debit/Bank Card;

- Overdraft Account (even if the beneficiary already has an account, a new overdraft account specific to this program must be opened)

- Installment Loan, Spot Loan, Usury, etc

- Working Capital Loan / Usury (*)

- Installment Loan

- Spot Loan

- Revolving Loan

- Cashless Overdraft Account products

- Other approaches suitable for Participation Banking

- Investment Loan (**)

- Installment Loan

- Other approaches suitable for Participation Banking including Finance Lease

(*)Participation Banks may disburse loans through appropriate methods for participation banking, regardless of Debit/Business Card

**This support package allows debtors who use investment loans under this package to access additional working capital loans not exceeding 10% of the respective investment loan, provided that the working capital loan is disbursed by the same creditor.

Fee and Commission Rates

- The KGF shall collect, in return for each guarantee it gives, a one-time commission corresponding to 0.5% of the respective guarantee amount from the beneficiaries through the lenders. In the event of debt restructuring, a commission amounting to 0.5% of the balance amount of the guarantee shall be collected in advance from the beneficiaries through creditors.

- In retun for each loan disbursed, creditors may collect a commission amounting to a maximum of 1% of the loan amount from the beneficiaries.

Special Conditions

- Beneficiaries are required to commit to not reducing the number of employees for a period of two years from the date of loan disbursement.

- Credit cards will be restricted for cash advances.

- For beneficiaries other than those holding a patent or Technological Product Experience (TUR) certificate, the credit to be used under this Protocol will be allocated for investments, provided that they operate in: the production/design/development of software, or mobile/desktop digital games; the development of software and technology related to the financial sector, artificial intelligence, big data, cyber security and blockchain; the development of software and services for smart cities and the green transformation; the development of services related to telecommunications, 5G, cloud and other communication types; the production/design or development of data centers, IT services, augmented/virtual reality software and hardware; the development of metaverse infrastructure, or the production/design and development of software and hardware for wearable technologies; and the development of NFT (non-changeable token) infrastructures.

- The amount of an investment loan cannot exceed 70% of the total amount of the investment to be made by the beneficiary.

- The amount of an investment loan to be used under this package cannot exceed 70% of the total amount of the investment planned or committed to by the enterprise.

- Beneficiaries may receive, for use as operating expenses, a cash amount of not more than 10% of the working capital loan allocated to them. (A working capital loan can only be disbursed by the creditor that disbursed the investment loan.)