Product Description

This package aims to finance SMEs and non-SMEs that are either exporters or operating in the services sector with foreign currency income.

Fund Used for Guarantee

Treasury Fund

Relevant Financial Institutions / Institution

Akbank, Denizbank, Garanti Bank, Eximbank, Halkbank, İş Bank, Türk Ekonomi Bank, QNB Finansbank, Vakıfbank, Yapı Kredi Bank, Ziraat Bank

Term of Product

- A grace period for principal amount for a maximum of 6 months

- A maximum of 24 months maturity (including the grace period for principal amount)

- For rediscount loans, a grace period for principal amount for a maximum of 12 months

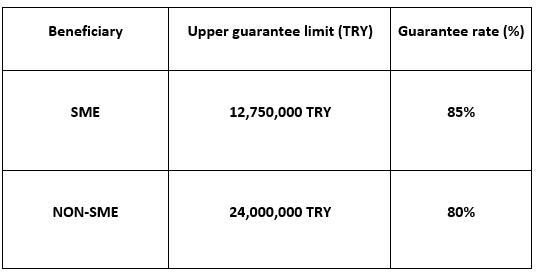

Guarantee Limits and Rates

The guarantee rate for rediscount loans is 100%.

Loan Products Available (*)

1.Business Credit Cards

- New Credit Card allocation

- Working capital loans that are to be disbursed to create a positive balance after making payments (including the following months) to a new Credit Card or existing Credit Cards that have no risk balance (Installment Loan, Spot Loan, Usury, etc.).

2.Connected to a Debit/Bank Card:

- Overdraft Account (even if the beneficiary already has an account, a new overdraft account specific to this program must be opened)

- Installment Loan, Spot Loan, Usury, etc.

3.Working Capital Loan / Usury

- Installment Loan

- Spot Loan

- Revolving Loan

- Cashless Overdraft Account products

- Other approaches suitable for Participation Banking

4.Non-cash Loans(**)(***)

* Guarantee is provided for the loans provided by the Lender to exporters or companies engaged in activities with income in foreign exchanges, provided that these loans are under commitment. This requirement is not valid for guarantees provided to tourism companies.

** Letters of guarantee to be issued for Rediscount loans addressed only to Eximbank

*** For non-cash loan disbursements, the Lender shall receive a commission amounting to 1% but no any additional commission for the letter of guarantee.

Fee and Commission Rates

- The institution shall collect, in return for each guarantee it gives, a one-time commission corresponding to 0.5% of the respective guarantee amount from the beneficiaries through the lenders. In the event of debt restructuring, a commission amounting to 0.5% of the balance amount of the guarantee shall be collected in advance from the beneficiaries through creditors.

- The lender may collect from beneficiaries a one-off commission equal to 1% of the loan amount in cash for each loan disbursement from the beneficiaries in return for the loan.

Special Conditions

- Beneficiaries may receive, for use as operating expenses, a cash amount of not more than 10% of the working capital loan allocated to them.

- The package offers loans denominated in TRY only.